When applying for a mortgage, one of the most popular options is a conforming loan. These loans are called “conforming” because they conform to the guidelines set by Fannie Mae and Freddie Mac, federally-backed home mortgage companies created by the U.S. Congress to boost homeownership.

What do Fannie Mae and Freddie Mac have to do with your home loan?

These entities exist only to support the U.S. mortgage system. They don’t originate loans. Instead, after a loan has been issued, one of the entities will buy the loan from the lender if it meets their criteria. This is an important part of the mortgage market because it allows lenders to sell loans to Fannie Mae and Freddie Mac and use the cash raised to engage in further lending.

For a loan to be purchased by Fannie Mae or Freddie Mac, the borrower generally needs:

- A good credit score

- A debt-to-income ratio of 50% or less

- At least 3% down payment

- A loan amount that’s equal to or less than the conforming loan limit

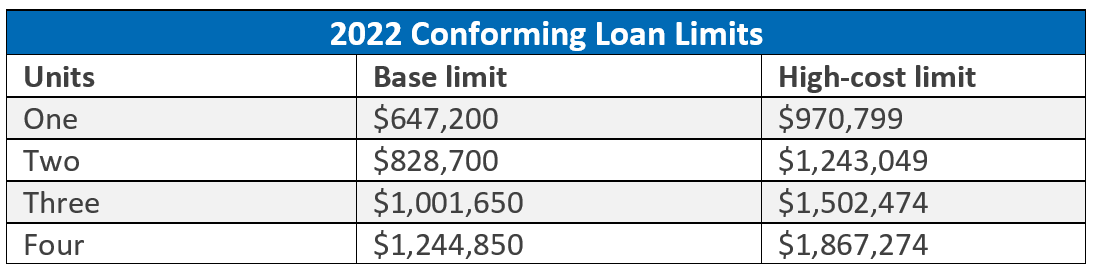

2022 conforming loan limits

Each year, the Federal Housing Agency decides what the conforming loan limit is. As houses become more expensive, the limits increase. In 2022, the amount increased substantially for all units.

Base limit: This is the maximum loan amount for homes in most areas of the United States.

High-cost limit: This is the maximum loan amount for homes in high-cost markets such as parts of Alaska, Hawaii, California, and Washington, D.C.

Units: The number of housing units per building.

More >> Check what the conforming loan limit is where you live.

Because conforming loans can be re-sold, they’re not as risky for lenders and often have favorable terms for borrowers. Savvy home buyers will keep their loan amount within the conforming loan limits so they have an easier time securing their loan, they’ll have more relaxed requirements, and their rates will probably be better.

If you’re looking for a conventional 15 or 30-year loan (as most people are), you may want to consider keeping the loan amount under the loan limit in order for it to be a conforming loan.

When you need a bigger loan – consider a jumbo loan

If the limits won’t get you a home you’re interested in buying, you could look into a jumbo loan. Jumbo loans won’t be purchased by Fannie Mae or Freddie Mac, so they don’t need to conform to their loan limits – meaning you can get more money. If you have a strong credit score and low debt-to-income ratio, you may find a lender willing to extend one to you.

However, jumbo loans come with some disadvantages. They have stricter qualification rules, require a sizable down payment (sometimes 20% or more), and normally have a higher interest rate. For those reasons, a lot of homebuyers try to avoid them by finding a home that will keep them within the conforming loan limits.

To see whether you’ll be eligible for a conforming home loan, contact your local Mann Mortgage home lender. Together, they’ll help you crunch the numbers to see what type of loan would be best for you.